MARKET UPDATE:

RECESSION FEARS HIT STOCK MARKET

STEPHANIE N. CAMPOS, CFP®

CERTIFIED FINANCIAL PLANNER™

After three months of positive stock market returns, August started with a significant two-day decline that seemed to be brought on by one small piece of economic data, the July unemployment number. We receive this and other economic numbers monthly and they normally don’t create panic selling, so why did it this time? Let’s see what the market is trying to tell us and how we can structure our portfolios defensively.

Job Market Data

U.S. Bureau of Labor Statistics1 reported today that our domestic labor market added 114,000 new jobs during the month of July. Even though that seems like good news, this number was lower than the expected 175,000 that economists had predicted. This affected the rate of unemployment bringing it up to 4.3% from 4.1% in June. This was seen as bad news that reignited the recession fear that the US has been fighting since 2022. Statistically, the unemployment rate is the highest since October of 2021 and it has been steadily rising for the past year ever since it jumped from 3.5% in July to 3.8% in August of 20231.

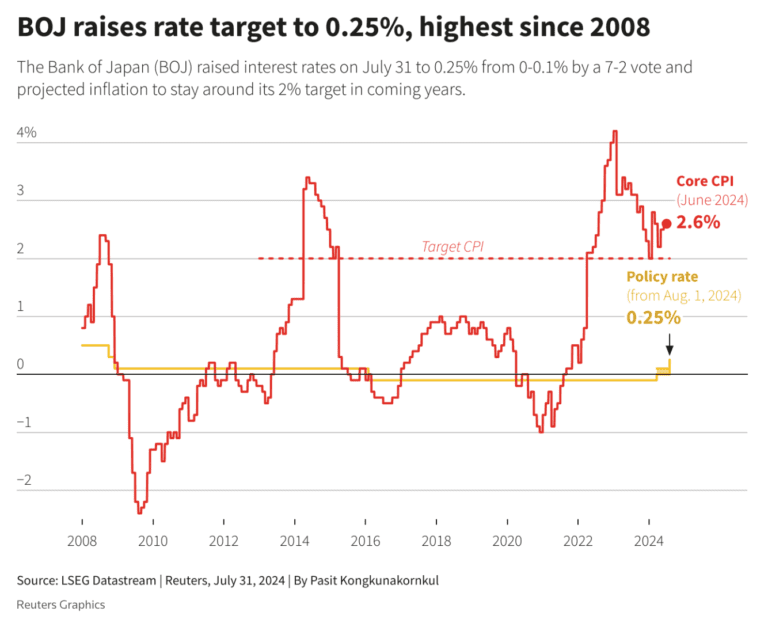

This one disappointing report wasn’t the only reason the stock market overreacted. It was simply the straw that broke the camel’s back, so to speak. There have been other weak US job-related numbers reported that up until recently the market shrugged off. Economists have been tracking lower wage growth and higher initial jobless claims for months. There are also headwinds internationally with the Bank of Japan (BOJ) raising their interest rates the most since 2008. The BOJ also decided to pull back on the amount of bonds that they have been buying, which pulls out a large amount of liquid cash which the market has come to expect.

The Manufacturing Sector

There are other parts of the economy that are showing signs of weakness and stress such as manufacturing. The Institute for Supply Management® (ISM®), which is a group of over 400 companies that report on their supply chains and inventories, stated that “economic activity in the manufacturing sector contracted in July for the fourth consecutive month.”2 They also reported that “demand remains subdued, as companies show an unwillingness to invest in capital and inventory due to current federal monetary policy.”2 The ISM’s mention of federal monetary policy alludes to our current high interest rates that the Federal Reserve, our nation’s central bank, have been reluctant to lower.

Interest Rate Environment

The Federal Reserve is known for avoiding fast moves that could create whiplash in the economy but they have taken a lot of criticism for it. After initially considering pandemic inflation to be transitory, they corrected course and began raising the interest rates back in March of 2022. It seemed to work because inflation came down from a high of 9.1% in June of 20223 to the current 3% rate. Since such a large improvement was made, most investors thought the Federal Reserve would lower rates. However, the Federal Reserve has consistently stated that the economy is strong and the interest rates are not causing a significant hardship. In fact, the Federal Reserve just met earlier this week on Wednesday and announced they still are not lowering the current 5.33% effective Federal Funds interest.4

The Chair of the Federal Reserve, Jerome Powell, in his press conference tried to clarify by saying, “the economy is moving closer to the point where it will be appropriate to reduce our policy rate…could be in September if the data support that.”5 This was the first time in several meetings that an actual timeline was mentioned for lowering rates but it was not enough to ease concerns. Consumers, investors and companies are all eager for lower interest rates that will fuel borrowing and investing. Many economists and investors fear that the Federal Reserve is late in lowering the rates and has been too slow to react to what the economic data is telling them. This is the basis of renewed recession fears.