Home » Market Update

June 18, 2021

MARKET UPDATE: INFLATION IS HERE, TO STAY?

STEPHANIE N. CAMPOS, CFP®

CERTIFIED FINANCIAL PLANNER™

As the world continues to battle the Covid-19 pandemic, the U.S. has already succeeded in vaccinating over half of our population1. That has not only alleviated the stress on our healthcare system, but it has also given us the opportunity to reopen our economy. During the lockdowns of 2020, most indoor restaurants, retail shopping malls and other businesses were closed. Americans were spending less and saving more. Now with summer upon us, Americans are excited to get out of the house and be more social. Since consumer spending has been between 60-70% of the U.S. economy since the 1960s, economists have been anticipating the pent-up demand we’re seeing now. This sudden high demand has driven up inflation, which is the government’s way of measuring price increases in the goods and services we purchase on a daily basis. So, the question is, as investors, how do we protect our income and savings?

What’s Driving Inflation?

The effects of inflation are usually gradual, but any rapid change in supply and demand, such as the disruption caused by the pandemic, can create noticeable inflation in the short term. During the worst part of the pandemic in the second quarter of 2020, our country’s factories had to shut down and our gross domestic product (GDP) fell by –34% from its average of +2.2%2 . The Institute for Supply Management (ISM), a non-profit organization with manufacturing members across 100 countries, stated “companies and suppliers continue to struggle to meet increasing rates of demand due to coronavirus impacts limiting availability of parts and materials.”3 This supply and demand dilemma can be seen impacting even the largest and most stable of American companies. For instance, although Apple Inc. has benefited from increased demand of their products during the pandemic, the company warned in an April conference call that supply constraints will have a revenue impact of $3 to $4 billion” in the following quarter.

Another reason that inflation is high at the moment is due to the way it’s reported. Inflation is usually reported over a 12-month period, which combines today’s inflation with the rate from 12 months ago. This is called the base-month effect. If we look at the economic numbers from 1 year ago, we are looking at numbers from April of 2020, which was when our economy came to a screeching halt. The consumer price index (CPI), which is used to measure inflation, was reported to have a 4.2% increase from the prior 12 months (April 2020-April 2021)5. That’s the largest 12-month increase since September of 2008 during the global financial crisis. This statistic made headlines as it sparked fear of another period of hyperinflation that Americans previously experienced during the 1970s.

However, a more reasonable way to measure inflation would be to remove the distorted months of the pandemic and use a baseline number that begins in Jan of 2020. The Federal Reserve Bank of Dallas did just that and when they ran the numbers, inflation, as measured with CPI, is only 2.2%. This paints a better picture of year over year price increases without the extraordinary impact of the pandemic’s base-month effect.

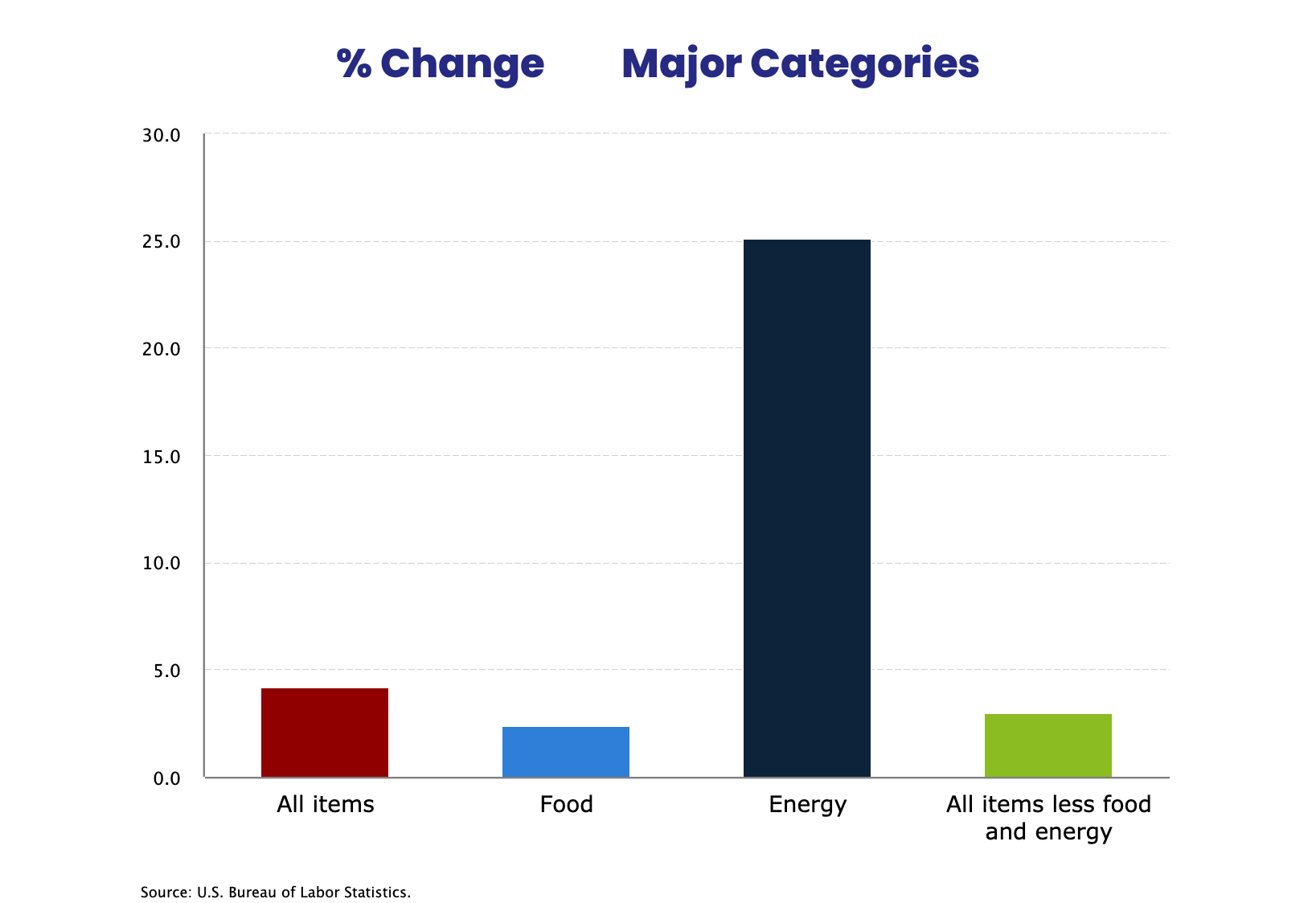

12-Month % Change in CPI, Mar 2020-2021, Reported in April 2021

Inflation can also be seen recently in energy prices, which along with food are left out of CPI due to their rapid price changes. For example, as seen in the chart above, a gallon of gasoline was $2.33 per gallon in March of 2020 and went up to $2.90 in March of 2021. That means that American drivers experienced a price increase of 24% in only 12 months. If we remove the base effect and look at the price change from January 2020 through March 2021, it’s still more than a 10% price increase.6 (These price increases occurred before the Colonial Pipeline ransomware attack in May of 2021).

The Fed’s Response

The Federal Reserve System, or The Fed for short, is the central bank which controls the supply of money and interest rates domestically. As the saying goes, there’s two sides to every story, and monetary policy is no exception. You may have heard the terms – inflation hawk or inflation dove, but what do they mean? A hawk is a government advisor who advocates for higher interest rates in order to keep inflation low, while a dove advocates for lower interest rates in order to focus on low unemployment.

Up until yesterday’s meeting, the Fed had a dovish policy and was waiting to see more progress in the labor market before they decided to raise interest rates. The unemployment rate went from 14.8% in April 20207 at the height of the pandemic, to 5.8% in May of 2021. Even with this sharp recovery in unemployment there are still 9.3 million people out of work. Before the pandemic, in February of 2020, the unemployment rate was 3.5% and there were 5.7 million people not working.8 The Fed revised their economic projections and announced rate increases equaling 0.50% by the end of 2023.9 This was a big departure from the language previously used which said rates wouldn’t increase until at least 2024, which implied it could’ve taken even longer.

Jerome Powell, the current chair of The Fed, announced a new way of managing inflation that will calculate the average historic rate rather than the annual rate previously used.10 Since inflation has been below the 2% target for the last 30 years, in order to bring the average up, The Fed will have to let the inflation rate go over 2% in the next few years. Janet Yellen, the first woman chair of the Fed from 2014-2018, told lawmakers in the House Appropriations subcommittee, “my judgment right now is the recent inflation we’ve seen will be temporary”. She went on to say, “I expect it to last, however, for several more months, and to see high annual rates of inflation through the end of this year”.11 Initially her comments were not well received, but now with The Fed’s new plan penciled in, the market is digesting what life will be like when rates are no longer at zero.

Importance of Planning

Even with this newfound clarity The Fed has provided, inflation will always be a point of contention whether it’s high, low or at a point of stagnation. The stock market is a forward-looking indicator, which means the current prices already reflect the strength of the economy expected in the next 6 months. Knowing this, investors who are planning for the future should focus their attention on diversifying their portfolios for growth and creating income if needed. Some of us remember when the 10-year Treasury rate was above 10%, but that hasn’t been the case since the 1980s and we haven’t seen even 4% since 2010.12 Now the 10-year Treasury rate is 1.5% and it spent almost all of 2020 below 1%13. This makes it extremely difficult for investors to keep up with inflation and avoid the erosion of our purchasing power without being invested in the stock market.

In my opinion, the best approach is to work with a financial advisor who is a CERTIFIED FINANCIAL PLANNER™. The financial planning process ensures that your portfolio will be well positioned to withstand the changes in interest rates and other parts of the economic cycle. At the moment, 20 of the 30 Dow Jones Industrial Average stocks pay more in dividends than the 10-year treasury rate. With this in mind, investors should work with a professional that can help them craft a portfolio that balances their need for growth and income with the risks of the market.

Inflation always impacts our income and savings, even the government recognizes this and that’s why social security payments have an annual cost of living adjustment. Shouldn’t your personal accounts do the same?