MARKET UPDATE:

BANK CRISIS: IS YOUR MONEY SAFE?

STEPHANIE N. CAMPOS, CFP®

CERTIFIED FINANCIAL PLANNER™

For many people, the news last Friday that a US bank had collapsed was shocking and harkened back to the global financial crisis of 2008. Silicon Valley Bank, also known as SVB, based in Santa Clara, California had provided financing to the technology and start-up community for almost 40 years before regulators had to shut it down and halt the trading of its stock.

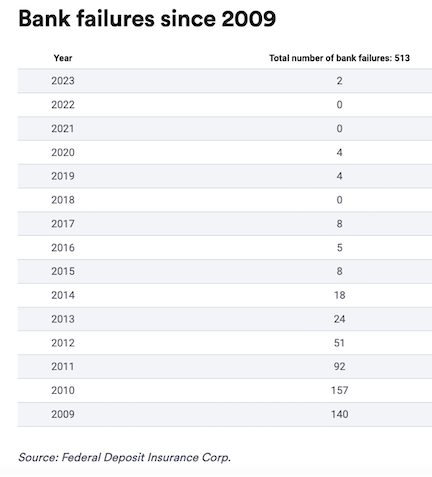

Over the weekend, New York’s Signature Bank also failed and now both institutions are under the control of the Federal Deposit Insurance Corporation (FDIC). Many of us are wondering how did this happen and is my money safe?

What Went Wrong?

SVB’s business was heavily concentrated in the technology sector which thrived during the pandemic but subsequently suffered a variety of financial challenges in 2022. After depositing over $100 billion, the bank’s primary customers experienced large stock market losses and low profit margins as their access to capital dried up. The bank’s tech customers were taking large withdrawals to stay up and running. This wouldn’t have been an issue if the bank raised enough capital of their own to keep the balance sheet healthy – but they never got the chance. The announcement caused panic over Twitter and customers began withdrawing all of their funds at once creating a run on the bank.

This wasn’t the only problem that resulted in SVB’s failure. The bank invested their customer’s deposits in Treasuries – like all banks do. The idea is that you give the money to the government for a set amount of time and in return you receive interest payments. Back when interest rates were low SVB concentrated their investments in long term Treasuries to get the most interest possible. However, when our central bank, The Federal Reserve, began raising interest rates last year any previously issued Treasuries were worth less since new higher paying Treasuries were now available. SVB was forced to sell these undervalued Treasuries to cover the withdrawal requests incurring $1.8 billion1 in losses that the bank didn’t anticipate.

Who Will Get Their Money Back?

The FDIC created temporary “bridge banks” and transferred all of the assets of SVB and Signature Bank into them in order for customers to access their money. Usually the FDIC adheres to a limit of $250K per person per account however a surprising announcement was made that even depositors with funds over these amounts will still be fully insured.3,4 Many of these uninsured depositors were businesses who needed those funds to make payroll and continue to operate. Normally depositors beyond the insurance limits will receive a receivership certificate and if enough money can be recovered from the sale of the bank’s assets then depositors are paid in full at a future date.

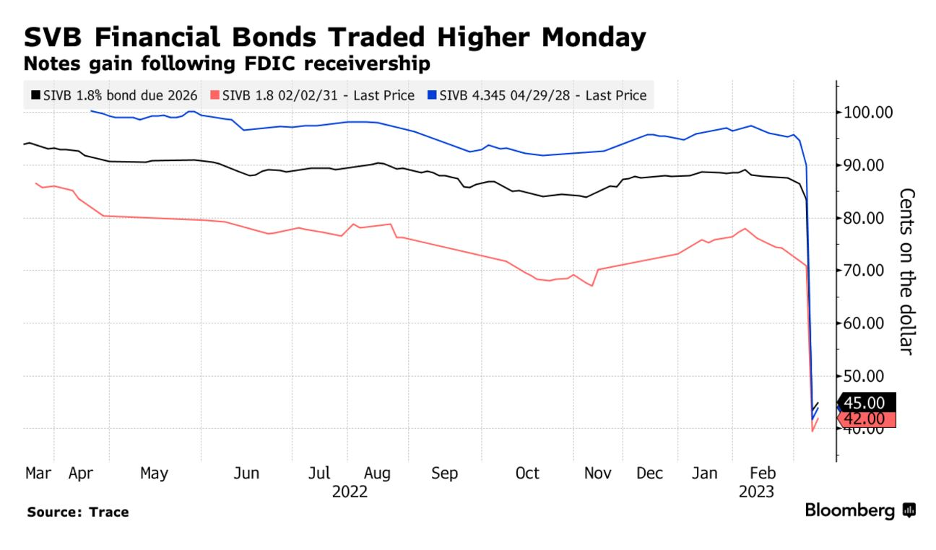

However, government officials were clear that investors in the bank’s stocks and unsecured debt such as bonds are not protected by the FDIC.5 As all of this was happening, SVB’s stock (SIVB) which normally traded around $300 per share lost 60% of its value in one day and then another almost 60% two days later before the trading of the stock had to be halted completely.

Other regional bank stocks also traded lower over fears of instability. First Republic Bank (FRC) was the worst performing stock of the group which was down over 60%, while PacWest Bancorp (PACW) and Western Alliance Bancorp (WAL) were also down over 40%.

SVB’s bonds also traded lower on fears that the bank will not be able to repay its bondholders back the money they borrowed. Before the crisis began, the bonds that were originally issued for $100 were trading between $84-$90 but as of yesterday, they are trading between $40-$50.